U.S. stocks advanced Wednesday afternoon to finish in the green, although the risk of a recession remains at the top of many investors’ minds.

The Standard & Poor’s 500 index rose for a third straight session, closing 0.4 percent higher at 3,845.08. The Dow Jones Industrial Average rose 70 points, or 0.2 percent, to close at 31,037.68 and the Nasdaq Composite Index gained 0.4 percent to close at 11,361.85.

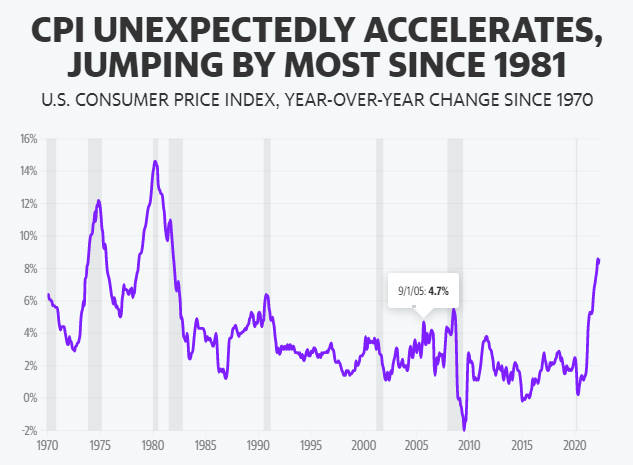

The moves came after the Fed minutes reiterated that the central bank remains focused on tightening monetary policy as needed to reduce inflation.

“Participants agreed that the economic outlook required a shift to a restrictive policy stance,” the minutes of the central bank’s June meeting said, “and they recognized that a tighter policy stance may be appropriate if inflationary pressures continue to rise.”

Earlier Wednesday, new data painted a mixed picture of current economic conditions. job openings approached 11.3 million in May, exceeding expectations and indicating continued labor market tightness and ongoing labor shortages associated with job openings. In addition, as of June, the Institute for Supply Management’s much-anticipated services index fell to its lowest level since May 2020, with services employment and new orders particularly weak during the month.

Crude oil prices stayed below $100 a barrel on Tuesday after falling below that threshold for the first time since mid-May, as investors increasingly bet that the economic downturn could depress energy demand. Bitcoin prices rallied to above $20,000. U.S. Treasury yields climbed across much of the curve, with the benchmark 10-year yield rising back above 2.9 percent.

The prospect of a deep economic downturn sparked continued market volatility as investors weighed whether inflation and a more aggressive Fed tightening cycle would dampen growth and send the economy into recession. Some key economic data, from consumer confidence to spending and purchasing managers’ indices, have softened or weakened in recent print.

Jonathan Miller of Barclays wrote in a recent report, “Overall consumer spending has already begun to slow generally this year, mainly due to deterioration in the goods category, with the services sector providing little offset.” He added that with the decline in the Conference Board Consumer Confidence Index and the University of Michigan Consumer Survey’s Sentiment Index, “this may indicate a more cautious mindset may develop, which will make households more inclined to hoard excess savings accumulated during the Pandemic.”

Whether – and if so, when and how deep – a recession has become a key question for market watchers and sent stocks into a bear market.

“Over the last few months, the market has been focused on the economy choking on inflation,” Matt Kishlansky, head of asset allocation at GenTrust, told Yahoo Finance Live. “There’s really no consensus between the equity and bond markets as to what we do in the meantime and where we go from here.”

In the bond market, the yield on the 10-year U.S. Treasury note has slipped to nearly 2.9 percent from a more than decade-high of more than 3.4 percent in mid-June. Federal funds futures show that investors are now pricing in the Fed’s final rate – or the rate at which the Fed will stop raising short-term rates – compared to a few weeks ago.

“So if you try to reconcile those two numbers, the bond market will tell you that the Fed will have to start cutting rates in response to the rate hikes coming from those hikes before the ink dries on the last one,” Kishlansky added. “[The] bond market is essentially saying that a recession is a fait accompli at this point. The stock market is less certain.”